Laid Off or Furloughed because of COVID-19 and now you cannot pay your child support? We answer your questions about Child Support and unemployment benefits.*

Even if you could not qualify for unemployment benefits before COVID-19, you might qualify now. “Can’t pay child support because I lost my job over coronavirus. The courts are closed and I’m being told that it’s a non-emergency. But they say I’m still expected to pay. Now what do I do?”

This is what we are hearing all over the country right now so we put together some information to help you through this time. Senator Grassley has already said that you don’t qualify for relief under the CARES Act for the Rebate or Credit. However, we may have found a way where you do qualify for relief if you were working and you have lost your job because of COVID-19. You now qualify if you have had your hours reduced, your income has dropped, or were even running your own business. Yes, self employment, independent contractor work, and freelancing are just a few more areas that are now covered under this emergency relief. Even if the child support division, your ex, or a Title-IV D judge disapproved of your choice of work and was upset at you for running your own business, doing odds and ends to make ends meet, if you are experiencing a loss because of the closures and shutdowns, been laid off or furloughed during this pandemic outbreak, you can get relief under these new unemployment rules.

Under the CARES Act just passed by Congress to help Americans get through the COVID-19 depression, unemployment benefits have been increased and extended not only to pay you longer and pay you more, but also to cover more people who didn’t qualify for unemployment before or who might have used up their unemployment benefits previously. Filing for unemployment just might keep you out of hot water with child support too. If you are having to pay more than $600 a week in child support, this is not going to cover all of the child support that you owe. But even if it doesn’t pay what you can so that when all of this coronavirus restrictions are lifted you will have shown good faith and will be in a better position to convince a judge that you deserve to stay out of jail.

Do I Qualify for Unemployment Benefits if I Cannot Pay Child Support?

Yes, as long as you became unemployed because of COVID-19 it won’t matter if you are , under the CARES Act self-employed, independent contractors, gig workers, freelancers are all qualified to receive benefits under this pandemic assistance program. There’s nothing that says because you owe child support you don’t get these benefits. In fact, if you were having trouble finding work and were do odds and ends as an independent contractor and couldn’t dig out before, this might be the relief you were needing.

Do I get Less Because I owe Child Support?

No. You will receive the full benefit. If your wages are being garnished however, you do still owe this money and there is a possibility that the state will withhold the amount you owe automatically. If you are ordered to inform child support when you are employed, you need to inform them when you apply for and receive unemployment benefits also. Do not play games with this, it will come back and bite you later.

How long will I get unemployment benefits?

You now get 39 weeks. Florida’s Unemployment Insurance used to max out at 12 weeks and $3,300 dollars. The CARES Act authorizes an extension of benefits of up to an additional 13 weeks for anyone who is still out of work when their state benefit period would normally run out.

So the total number of weeks you can get now is up to 39 weeks at $600 a week.How Long Do I have to wait before I can apply?

The relief bill is encouraging states to waive the waiting period. Typically states would have you wait a week before you could apply. But you might find that this is different under the COVID-19 shelter-in-place shutdowns. So you should apply the day you become unemployed. Each state has been updating their unemployment pages with information about how to get the money benefits from the COVID-19 stimulus bill package.

What is the waiting period to receive the unemployment money?

During non-pandemic outbreak times, it could take up to two to three weeks to get a check. These wait times could be even longer at first, until the federal government gets more staff in place to process the claims. Unemployment offices are also receiving advanced notice from employers, or at least they should be, to help the states better estimate the number of applications they might need to prepare for.

Do I need to look for work while I collect unemployment?

Normally when you collect unemployment you have to submit a certain number of job applications where you applied to continue eligibility. But that is being waived right now too. You might have to continue to show that you are still unemployed. You will find out when you apply what your particular state is requiring you to do.

However, if you are required to pay child support you will want to check with your worker if your state has those assigned to obligors and ask them if they are going to require you to search for work during this time. If you are usually a mid to high-end earner you might want to let them know that anything you do get may be much lower than what you were making before, and find out whether there is anything additional that the worker wants you to do to make sure you have complied with your state’s requirements.

Document everything that you do. You know how government is, they aren’t going to keep track for you. And you don’t want to wait until there is a problem before you start thinking about getting all of the steps you took to make sure you were covered regarding child support.

Can I apply if my hours were cut but I’m still employed?Yes. Florida for instance says that just because you work part-time or have a temporary job does not mean that your benefits will stop completely.

Benefits Extensions

Benefits have been extended 14 more weeks for a total of 39 weeks. And the amount of money that you can receive has increased. For instance Florida state has a maximum total benefit amount of $3,300, where your Reemployment Assistance payments will end. However, the CARES Act has increased the amount you receive every week. You will receive an additional $600 a week on top of what you would normally receive from your state. And the cap is waived at this time. You could receive an additional $23,400 over 39 weeks if your unemployment continues for that long. This unemployment insurance benefit will end July 31, 2020. That does not mean that your benefit stops paying on that date, that means that you need to apply for it before that date ends.

Don’t delay, start working through these steps the day you are laid off, fired, or furloughed. If you have had your hours reduced but are still employed, it is unclear whether there are any benefits for that situation. You would then default to the regular child support process that was in place before COVID-19 and document and be prepared to address the problem as instructed in your state. There may be nothing different that you need to do. It is going to be frustrating and scary especially for those who have never missed a payment and never had to worry about not being able to pay. The Attorney Generals, Governors, Mayors, Judges, Legislators, and attorneys are all aware of this problem. You might have an organization in your state that has been keeping them abreast of your needs and you will want to contact that organization and find out how you can be of assistance to them since they are assisting you. If you do not know of one in your area, contact an advocate or divorce coach through Facebook and they can connect you with someone in your local area. Search key words like “child support reform,” “family court reform.” This way you will avoid just getting attorney listings and can get in touch with someone who is interested in getting relief put in place to help you now and not just wait on the system.

Additional Unemployment Benefits

In addition to the Reemployment Assistance Program, there are other programs to help the unemployed. These are different than unemployment benefits, and you need to apply for them separately in your state. Eligibility for one benefit does not guarantee or prohibit eligibility for another. For example, you might be eligible for Paid Family Leave, Disability Insurance, or some other program as well.

If you were doing odds and ends jobs trying to make ends meet, the CARES Act has expanded the unemployment insurance to cover freelancer, gig worker, and independent contractor. These were never covered before. So even if your state doesn't provide benefits for this type of worker, you qualify under the federal benefits program. You would still apply through your state.

If you were working in many different states, you would apply through the state where you live. Your state will inform you if you need to apply somewhere else or do something different. If you get denied based on applying in the wrong place, you have time to apply elsewhere. The program is good through July 31, 2020 and they are going to pay you retroactively as long as the date of your unemployment started during the COVID-19 time period designated by the CARES Act.

$600 a week in addition to what your state normally pays out for unemployment. However, if you don’t qualify for your state unemployment benefits, you might still qualify for the emergency money from the CARES Act, so you would still get the $600 a week if you fall under the expanded categories established by the federal government. If you qualify for your state unemplooyment benefits as well, you get both as of the date of this posting. Always check your state’s page for any updates.For example Florida allows $257 dollars a week and a maximum of $3,300 total benefit over a 12 week period. The CARES Act increases that amount to $600 more in addition to the $257 maximum and a total of 39 weeks, extending the 12 weeks out to a total of 39 weeks and a total of $24,300 more on top of the $3,300 state maximum. These are two separate programs, a state program and a federal program. You are allowed to combine these two programs.

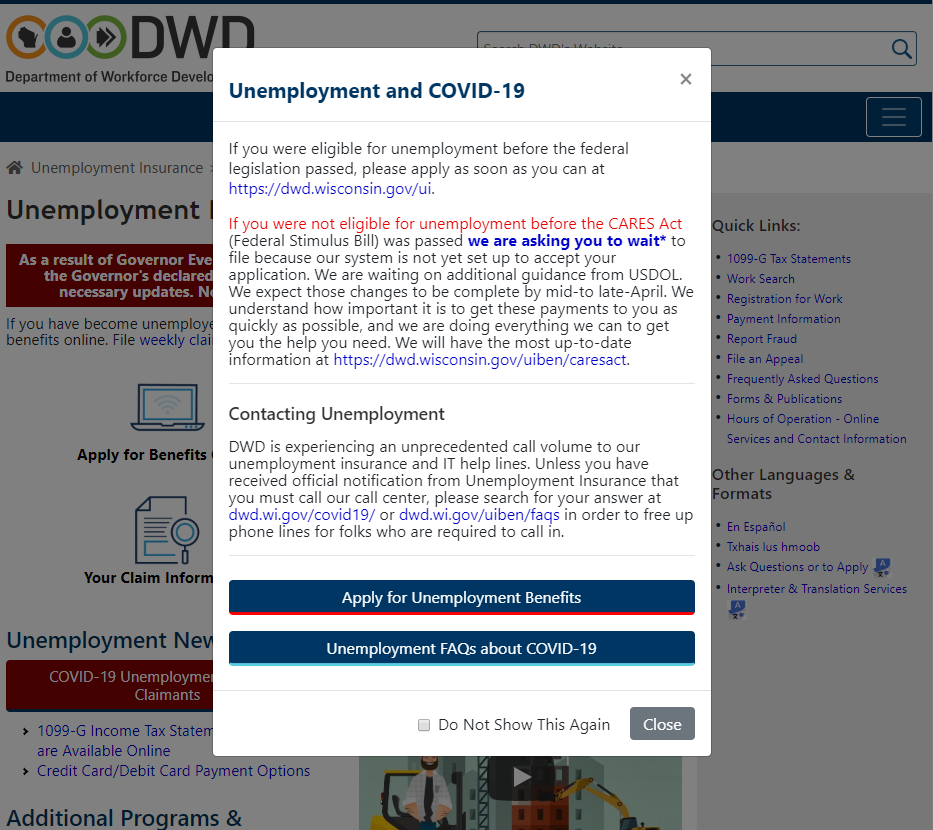

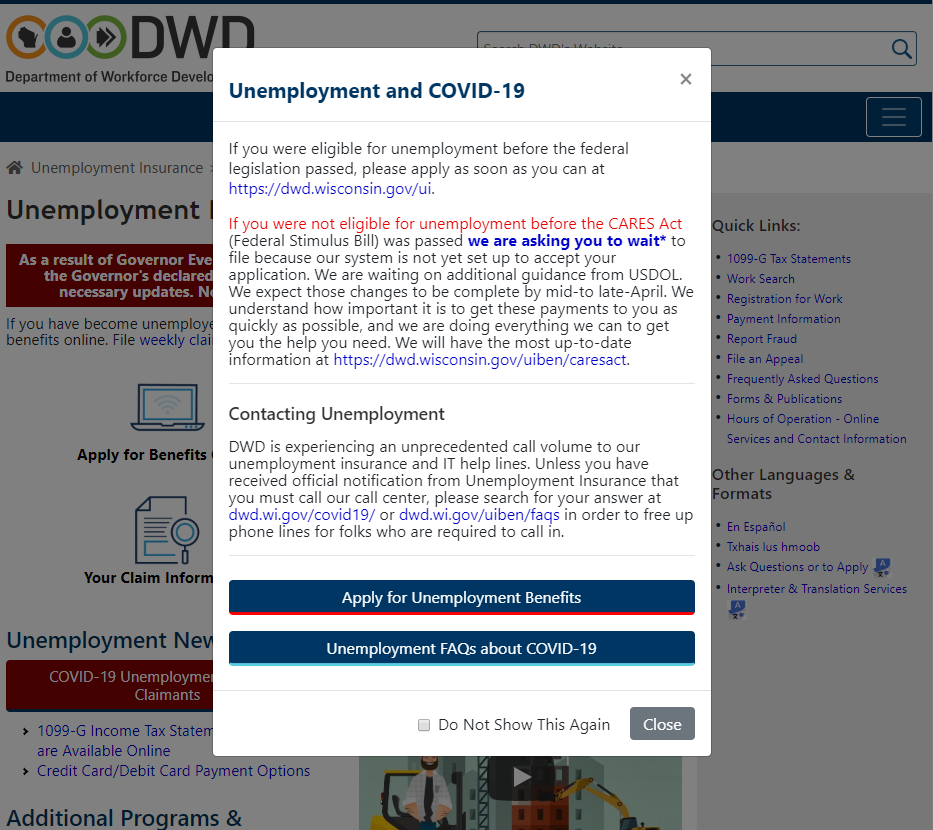

There are unprecedented number of calls and applications being filled out online. Some states have put up popup notices letting you know optimal times to apply and to let you know that they acknowledge that you cannot get through.Wisconsin put up this notice.

Child Support Guide for Parents during COVID-19 for unemployment benefits

So here are the steps you should take to make sure that you are not the first person they come after when this pandemic is over:(See our downloadable guide that has even more tips and steps that include communicating with the other parent, sample statements for your child support officer, and more.)

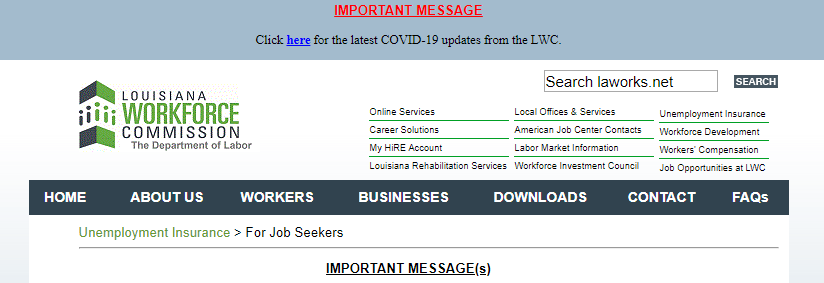

- File for unemployment. Look for the application that relates to COVID-19 unemployment insurance (UI) that have been implemented in all 50 states in the United States and its territories. You should see some information at the top of your state’s page or in a pop-up on their main unemployment benefits page. Prior to COVID-19 states had their unemployment benefits divided into categories, and they might have had a general disaster-related category like California does. If your state does not have anything up regarding COVID-19 you might try that benefit section for Disaster-Related Unemployment applications.

- Contact your worker or child support office if you don’t have a worker, and find out what steps they would like you to take regarding your recent job loss or inability to find work at this time.

- A) leave a message if you don’t get anyone on the phone in person.

- B) Follow-up your message with email if you have one and snail mail and keep a copy.

- C) Document all of the steps that you take, who you talk to, what numbered you spoke to them at, and the date and time, and the steps they told you to take.

- Check in with your unemployment office every week to ensure your benefits continue unless your state tells you otherwise.

- Contact the child support office and learn about any process for modification of child support, forgiveness, or any other relief already built into the process for modifying your child support order.

- A) The process for altering your child support amount might be suspended at this time, however, the rules have not been changed for when you qualify for a modification or relief. Check your Attorney General’s website in your state where your order is enforced to find out the process. And know that most courts do not consider child support changes an emergency so hearings for this are most likely delayed. If you are worried about the other parent or the state enforcing your order, again, contact them and keep documentation and just know that there are many, many like you who will be in the same boat and the state agencies know this. They will deal with it as the time comes. So in the meantime just prepare yourself with as much evidence as you can about how the coronavirus pandemic has affected you so that when your day in court comes you can satisfy the criteria and avoid being jailed for a legitimate inability to pay.

- B) Find out if there is any other relief you can get during this time if you cannot pay your child support. You don’t need to panic though if you are new to missing child support payments and were a good payer before that, and you are documenting that you have contacted the child support office to inform them of the financial changes in your life, you have done what you can do. And make sure you really are doing what you can do to satisfy the child support payment as best you can even if it is just $5 or $10 dollars. You will be showing good faith.

- C) Some states require that your inability to not pay be more than just temporary to qualify for a modification. So if this pandemic passes in a few months and you are able to get re-employed then you will just be negotiating the arrears that have accrued during this time.

- D) Contact your attorney, Governor, Attorney General, legislators, your representative in Congress, and the President’s office and let them know that you would like child support relief and relief from the interest that will be accruing during the missed payments as well.

- E) If you were behind in child support payments before this pandemic hit and you were trying to find work or were working as much as you could find and trying to pay, but now this virus outbreak has just made it impossible, you will want to document all of this as well for your defense.

- f) Learn the arguments that we make regarding the states and their ability to pay criteria. There is a lot to be argued about this. So if you have the time learn this now. You won’t be able to use it now unless they decide to enforce against you during this time period. While it is unlikely there are some things in the states that were automatically triggering and so you may find yourself having to deal with this if you are in one of the states that has vowed to still hear child support contempt.

- G) If you would be able to work and are considered an essential but your driver’s license has been suspended, get in touch with the Governor and let him/her know this problem as well as ask your legislator and attorney to contact the judges and ask for a stay of the enforcement until the shelter-in-place orders are lifted and after things have gone back to normal.

- Once you start getting unemployment benefits, pay something on your child support. If you are getting enough from unemployment to continue to pay your child support in full, you must continue to do so unless you got an order saying otherwise. Your child support order is not changed unless there is a new order making changes. You can check your state Supreme Court COVID-19 orders, and your Governor’s COVID-19 orders for any changes to child support payments made by your state. As of the date of publishing this blog child support orders remain in place.

LINKS TO UNEMPLOYMENT APPLICATIONS BY STATE:

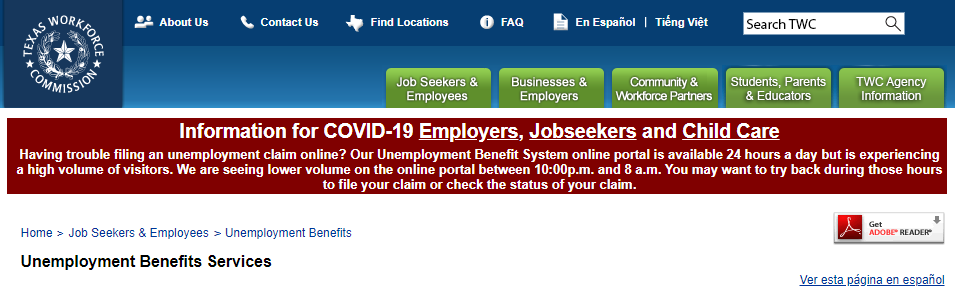

If you have an order to pay child support and have lost your job, had your hours cut, or are making less because of COVID-19. The CARES Act may provide you with some relief. Normally parents who fall behind in child support don’t find relief, but this time in these unprecedented times, you may qualify for unemployment benefits from the CARES Act.Texas has added the COVID-19 benefits to their website in addition to their regular unemployment insurance benefits.If you are behind in child support and are required in the state of Texas to inform the Attorney General’s office Child Support Division if you have changed or lost your job, you will also want to inform them that you have applied or are trying to apply for the COVID-19 unemployment benefits. In addition to checking your child support order and following the steps in your order, here is a child support checklist to some basic steps to follow:1. Notify the other side’s attorney (or the other party if they don’t have an attorney of record anymore). Technically, you should be sending your notices to the addresses that are on file with the court and the state case registry.2. Notify and update the State Case Registry of any address changes by mailing a file-stamped copy. Many people move when they lose a job so make sure you are following your orders for who, where, and how you are to notify of any address changes. This way you will get notices sent to you to the right place too. Remember to notify the Attorney General’s child support office too.2. Contact the Attorney General’s office child support division and inform them that you have lost your job, your income has been reduced, or that your hours have been reduced, and that you are applying for the COVID-19 CARES Act assistance. If you have a particular person you have been in contact with or directed to contact use that information. Ask them to make a note of this and ask if you can send them an e-mail so that you have proof that you have notified them in writing. Also ask what address they want you to mail the notice too if there isn’t one in your child custody orders.Here is some general contact information in case you cannot find yours in the AG is involved in your case:(If applicable). Send a file-stamped copy of your Noticeof Current Address formto the State CaseRegistry and to the Office of the Attorney General if it is involved in your case.

If you have an order to pay child support and have lost your job, had your hours cut, or are making less because of COVID-19. The CARES Act may provide you with some relief. Normally parents who fall behind in child support don’t find relief, but this time in these unprecedented times, you may qualify for unemployment benefits from the CARES Act.Texas has added the COVID-19 benefits to their website in addition to their regular unemployment insurance benefits.If you are behind in child support and are required in the state of Texas to inform the Attorney General’s office Child Support Division if you have changed or lost your job, you will also want to inform them that you have applied or are trying to apply for the COVID-19 unemployment benefits. In addition to checking your child support order and following the steps in your order, here is a child support checklist to some basic steps to follow:1. Notify the other side’s attorney (or the other party if they don’t have an attorney of record anymore). Technically, you should be sending your notices to the addresses that are on file with the court and the state case registry.2. Notify and update the State Case Registry of any address changes by mailing a file-stamped copy. Many people move when they lose a job so make sure you are following your orders for who, where, and how you are to notify of any address changes. This way you will get notices sent to you to the right place too. Remember to notify the Attorney General’s child support office too.2. Contact the Attorney General’s office child support division and inform them that you have lost your job, your income has been reduced, or that your hours have been reduced, and that you are applying for the COVID-19 CARES Act assistance. If you have a particular person you have been in contact with or directed to contact use that information. Ask them to make a note of this and ask if you can send them an e-mail so that you have proof that you have notified them in writing. Also ask what address they want you to mail the notice too if there isn’t one in your child custody orders.Here is some general contact information in case you cannot find yours in the AG is involved in your case:(If applicable). Send a file-stamped copy of your Noticeof Current Address formto the State CaseRegistry and to the Office of the Attorney General if it is involved in your case.- Mailing address for the State CaseRegistry.

- See the “Noticeto the State CaseRegistry” section of your orders (if applicable) for the address. For most cases, the address is:

- State CaseRegistry, ContractServices Section, MC046S, P.O. Box 12017, Austin, Texas 78711-2017

- See the “Noticeto the State CaseRegistry” section of your orders (if applicable) for the address. For most cases, the address is:

- Mailing address for the field office of the Office of the Attorney General Child SupportDivision (OAG Child SupportDivision) that serves the county where your courtorders issued from.

Because of the number of people filing for unemployment you might have difficulty getting through to someone, the page where the application is might be broken. The recommendation is to try at non-peak hours, when there is less traffic on the internet between the hours of 10 p.m. and 6 a.m. in some areas. Just keep trying. Some states, like Wisconsin are asking for you to fill out application only if your unemployment was before the federal legislation passed, and to wait if yours is related to COVID-19. You might see something like this pop-up:

Other types of unemployment programs that were available in some states were Disaster Unemployment Insurance, Disability insurance, and Paid Family Leave. You can combine these programs and are entitled to receive these benefits as well. Check with your state to see if you need to fill out separate applications for each one and how to indicate that you are requesting additional benefit programs. The following example is what you will see on California’s unemployment page.

California Disaster Related Unemployment Application

Program Eligibility

If you lost your job or cannot work because of a disaster or emergency, you may be eligible for one of the following programs.Unemployment Insurance

If you are unemployed due to a disaster or emergency, you may be eligible for UI benefits.When you file your UI claim, you must tell us that you are unemployed as a result of a disaster or emergency.Disaster Unemployment Assistance

If the President of the United States declares a disaster in your area, DUA may be authorized. If you become unemployed as a result of the disaster, and you do not qualify for regular UI benefits, you may qualify for DUA.For more information, view Fact Sheet Disaster Employment Assistance(DE 8714DUA) (PDF).Disability Insurance

If you become ill or injured and cannot work, you may be eligible for DI benefits.Paid Family Leave

If you need to care for a family member injured in the disaster, you may be eligible for PFL benefits.

* Make sure you call an attorney and the child support office in your state. This could be the Attorney General’s office or another Title-IV D office. You will need to check with your state child support agencies to find out more about what you need to do to stay out of trouble with child support. The information in this blog is general and not specific to any one person or case. Do not rely on it solely for your particular case. Just use it to get you started. Your state might have more steps or different instructions than what we provide here.

https://www.usatoday.com/story/money/2020/04/03/unemployment-benefits-lost-your-job-over-coronavirus-whats-covered/5110862002/